Technology Sector Enjoys Strong Earnings Momentum

Jeff Buchbinder | Chief Equity Strategist

Last Updated:

Earnings season last week and this week is all about financials. The early reports were a bit messy, with earnings dragged down by special bank charges to replenish the FDIC deposit insurance fund following last year’s bank failures.

LPL Research still thinks a respectable 5% increase in S&P 500 Index earnings per share overall is achievable given low analyst expectations. But one big determining factor in whether that upside materializes will be the “Magnificent Seven.” That is, the big seven tech companies, which sit atop the S&P 500 Index are expected to collectively grow earnings 46% in the fourth quarter, compared to a 7% decline expected for the rest of the S&P 500 Index (the “493”), as discussed in this week’s Weekly Market Commentary.

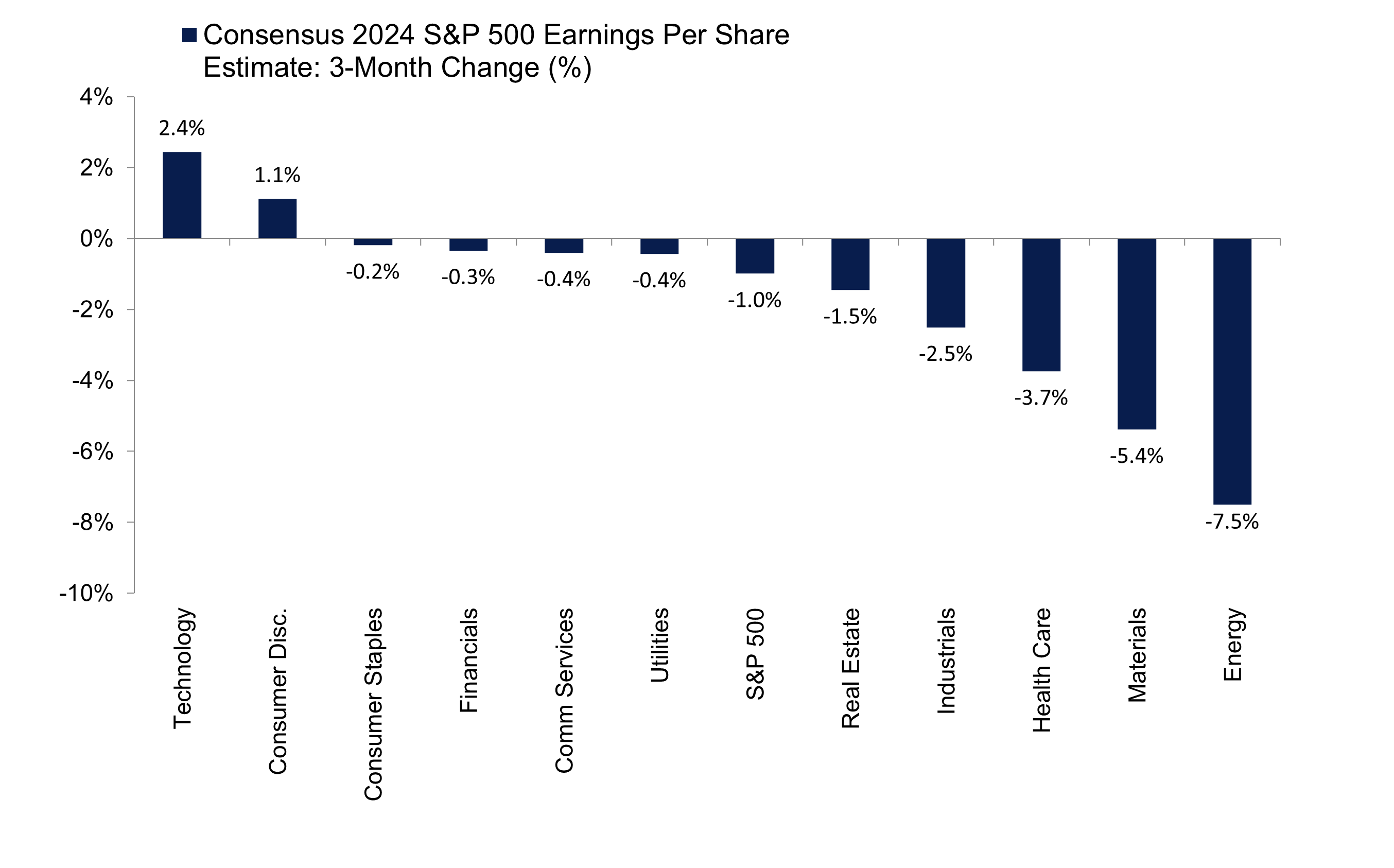

Where are the best earnings revisions heading into reporting season? The answer — technology. We rank 2024 earnings estimate revisions over the past three months in the chart below, where technology is a clear standout. The sector is expected to grow earnings by about 15% during the fourth quarter based on current analysts’ estimates, well above current estimates for the S&P 500 Index below 2%.

Technology Sector Enjoying Strong Upward Revisions to Earnings Estimates

Source: LPL Research, FactSet 01/16/24

Disclosures: All indexes are unmanaged and cannot be invested in directly.

Estimates may not materialize as predicted.

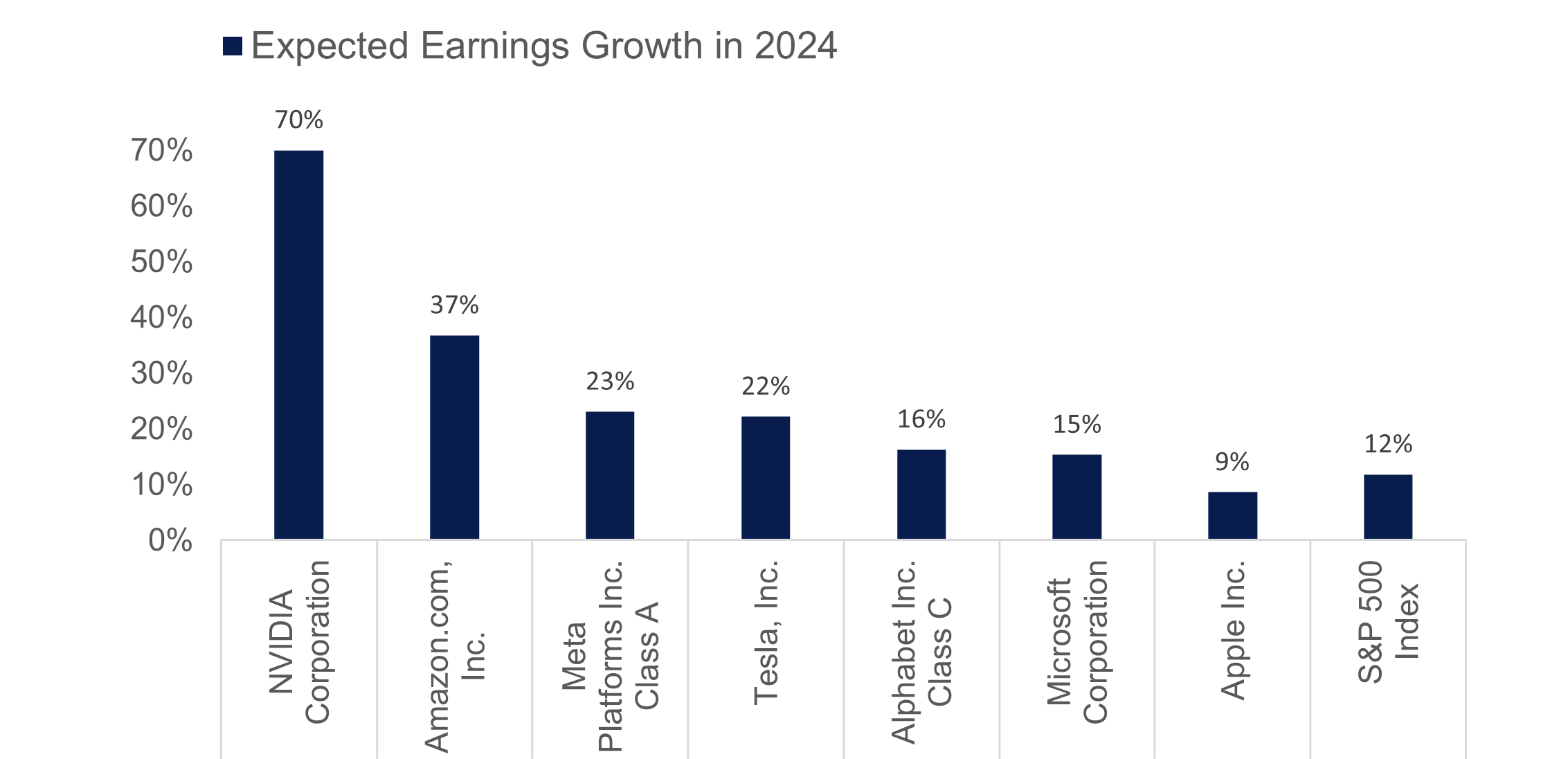

Not only has technology experienced nicely positive estimate revisions in recent months, but sector expectations for earnings growth in 2024 are quite robust. In fact, analysts expect the technology sector to grow earnings 17% this year, topping the other 10 S&P 500 Index sectors and supported by several demand tailwinds, notably artificial intelligence (AI) and cloud computing. The increase in optimism heading into earnings season provides some evidence that these high expectations may be achievable, driven by some of the biggest technology companies in the market that will likely be the biggest earnings story of 2024.

The Biggest Earnings Story of 2024: The Magnificent Seven

Mega Cap Tech Earnings Still Growing Nicely

Source: LPL Research, FactSet 01/16/24

The Magnificent Seven includes Alphabet (GOOG/L), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA).

Disclosures: All indexes are unmanaged and cannot be invested in directly.

Estimates may not materialize as predicted.

LPL Research maintains a neutral to slightly positive outlook for the technology sector, with a positive bias, and favors growth style over value in its latest recommended tactical asset allocation. LPL Research maintains a positive outlook for the communication services sector, with its more attractive overall valuations. The sector offers substantial exposure to the “Mag Seven,” with Alphabet and Meta among its top holdings.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #528436